What we did:

Naveed and Samiya Parvez set up Andiamo following the death of their son, who had cerebral palsy, to improve the process that people with the condition experience when being measured for splints and braces.

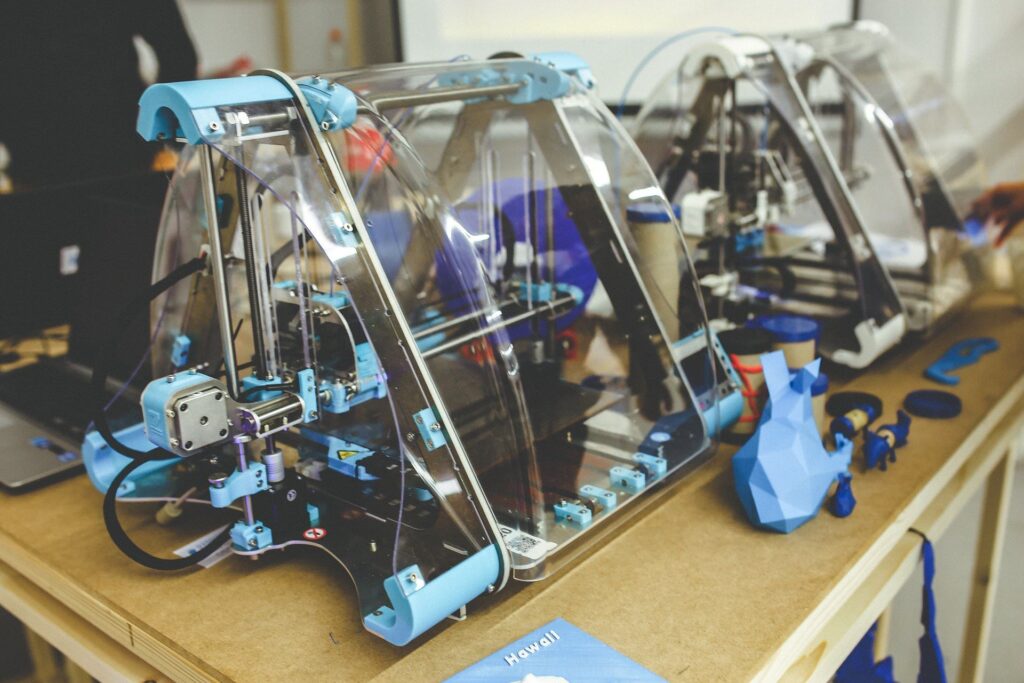

The traditional plaster cast method is painful, time-consuming and expensive. But, Andiamo’s handheld 3D scanner measures a person’s entire body in around one minute and gives an accurate measurement, minimising the need for patients to get refits. The 3D-printed orthosis is light, processed quickly and costs significantly less than other options currently available.

It’s the only product of its type that focuses on paediatrics and, according to market research, the global custom-made-orthotics market will be worth £2.7bn by 2020.

Capital provided legal advice to NCL on its £500,000 investment into the company, working closely with Jonathan Synett, NCL’s Investment Director. The deal also included an investment into a Polish subsidiary by a co-investor.

What happened:

This investment will be key to Andiamo’s ambitious growth plans. Andiamo currently has 30 patients, and plans to have 100 more within 18 months, treating 15 million children in the next 10 years.

Speaking about the investment, Jonathan Synett said:

“Our investment in Andiamo is a fantastic example of what our new fund is set up to do. The company has the potential to make a real difference with its revolutionary medical technology.

We want to work with investee companies to make the process as smooth as possible and we need lawyers that are sensible, efficient, and understand the expectations of fast moving tech companies in closing out funding rounds. We are very glad we have advisers in Capital to support us through the process, and are already looking forward to working with them on future investments.”

Jordan Thomas, who worked on the deal, said:

“This is an exciting investment into a company which has huge potential and can transform this area of paediatric medicine. It’s been an absolute pleasure to work with NCL on this project and we look forward to watching the company flourish.”